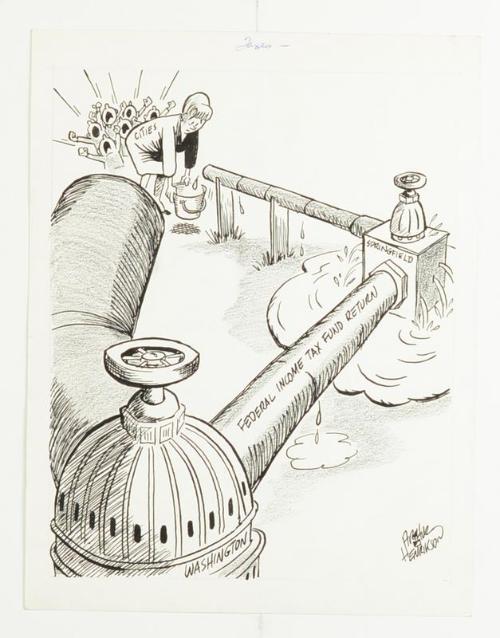

Taxes

Artifact ID1973.1.2938

Object Type

Cartoon Drawing

Artist

Arthur Henrikson

Gifter

Arthur Henrikson

Medium

Ink and grease pencil on drawing paper

DimensionsOverall H 11 in x W 8 1/2 in (27.9 cm x 21.6 cm )

Physical DescriptionPhysical DescriptionOriginal cartoon drawing. A pipe ("Federal Income Tax Return") from the Capitol carries water to a leaking valve ("Springfield"), from which another pipe carries a small trickle to a woman ("Cities") with crying children behind her. A large pipe goes to the Capitol. Caption: “Taxes”. Artist signature lower right: "Arthur Henrikson”.

Historical NoteWhen Lyndon B. Johnson signed the 1964 Revenue Act that decreased income taxes and refused to raise taxes, spending by consumers and businesses increased. Along with government spending from the Vietnam War and Great Society, all of this increase of demand led to inflation. To slow down the economy and prevent further inflation, either spending had to be cut or taxes had to be raised.Additional Details

Custodial History NoteThe item was a gift from the general public to President Johnson during his term in office. It was received by President Johnson, until the President donated it to the Lyndon B Johnson Presidential Library in 1973.

Credit LineGift of Lyndon Baines Johnson

National Archives Catalog CollectionLyndon B. Johnson Library Museum Collection (National Archives Identifier 192413)

National Archives Catalog SeriesGifts from the General Public (National Archives Identifier 189698395)

Use Restriction StatusRestricted - Fully

Use Restriction NoteCopyright or other proprietary rights are held by individuals or entities other than the LBJ Presidential Library and Museum. The LBJ Presidential Library and Museum does not warrant that the use of materials will not infringe on the rights of third parties holding the rights to these works, or make any representations or warranties with respect to the application or terms of any international agreement, treaty, or protections that may apply. It is your responsibility to determine and satisfy any copyright or other use restrictions. Pertinent regulations can be found at 36 C.F.R 1254.62.

In Collection(s)

Not on view

Place Described

Place of Publication

Related Links